We are AMFI Registered MutualFund/NPS Distributors.As Financial Guidance Service professionals, we act as strategic partners, leveraging our financial expertise and analytical tools to guide our clients through the complexities of the financial landscape, ensuring their resources are optimally managed and strategically deployed to realize their desired financial aspirations.

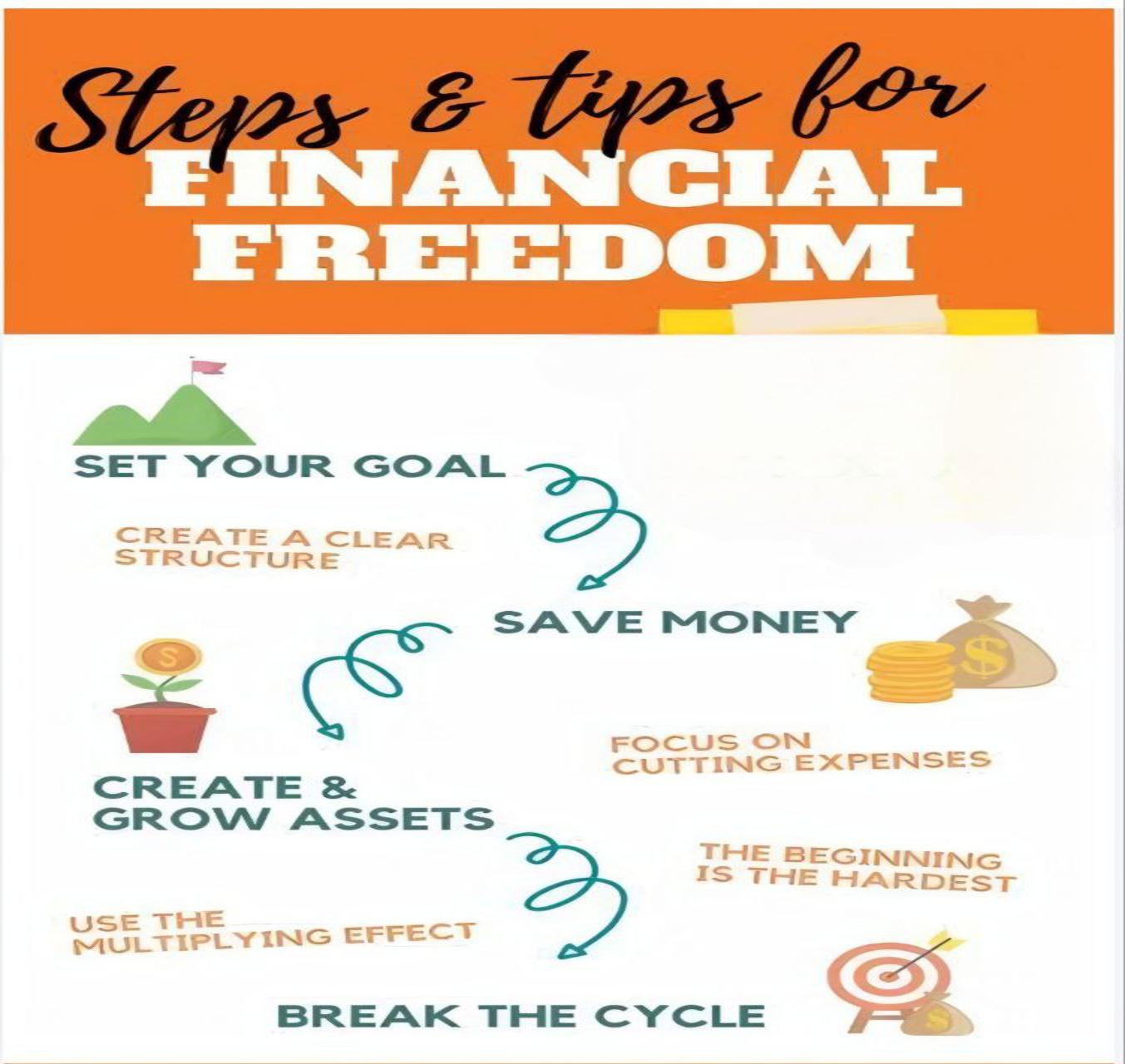

We go beyond surface-level information to truly grasp their unique desires, whether it's early retirement, funding education, buying a home, or securing their family's future. This involves active listening, asking insightful questions, and building a strong, trusting relationship

Based on their goals, current financial situation, and risk tolerance, we develop tailored strategies and comprehensive financial plans. This includes budgeting, investment management, retirement Guidance, tax optimization, insurance analysis, and estate Guidance, all aligned to their specific objectives

We act as their trusted partner, offering continuous advice, monitoring their progress, and making necessary adjustments to their plans as their life circumstances and market conditions evolve. We educate and empower them to make informed financial decisions, keeping them focused and accountable on their journey towards achieving their desired goals.

Unlock your full financial potential and achieve ambitious growth with InvestMonk's premium financial services, tailored for exceptional results. Experience expert guidance and strategic solutions designed to significantly elevate your financial trajectory and secure your future prosperity.

Financial Guidance for investment is the process of setting investment goals, assessing risk tolerance, and creating a diversified portfolio to achieve those goals. It involves ongoing monitoring, adjustments, and aligning investments with your overall financial plan to build wealth and secure your financial future.

Mutual funds offer diversification, professional management, and liquidity. They allow investors to access a variety of asset classes with relatively small investments, simplifying portfolio management.

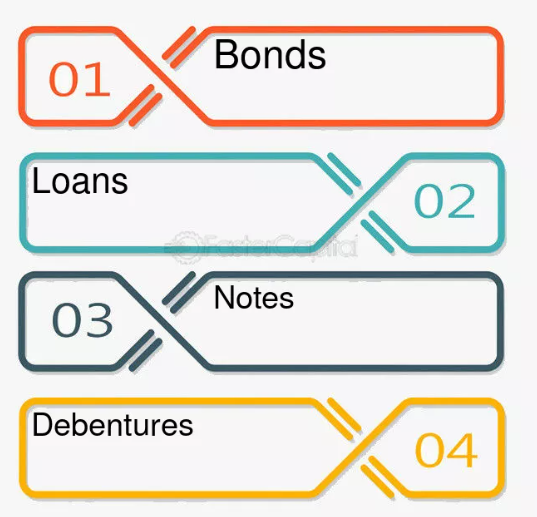

Debt instruments offer investors a steady stream of income at a predetermined rate, providing stability and predictability. They carry a lower risk compared to equity investments, making them suitable for risk-averse investors. Debt instruments can also help diversify a portfolio, reducing overall risk..

Unlike mutual funds, PMS/AIF provides tailored investment portfolios aligned with your specific financial goals, risk tolerance, and investment preferences.

Insurance offers financial protection against unexpected events, providing peace of mind and mitigating potential losses. It helps individuals and businesses manage risk by transferring it to an insurer, who agrees to pay for covered losses in exchange for a premium.

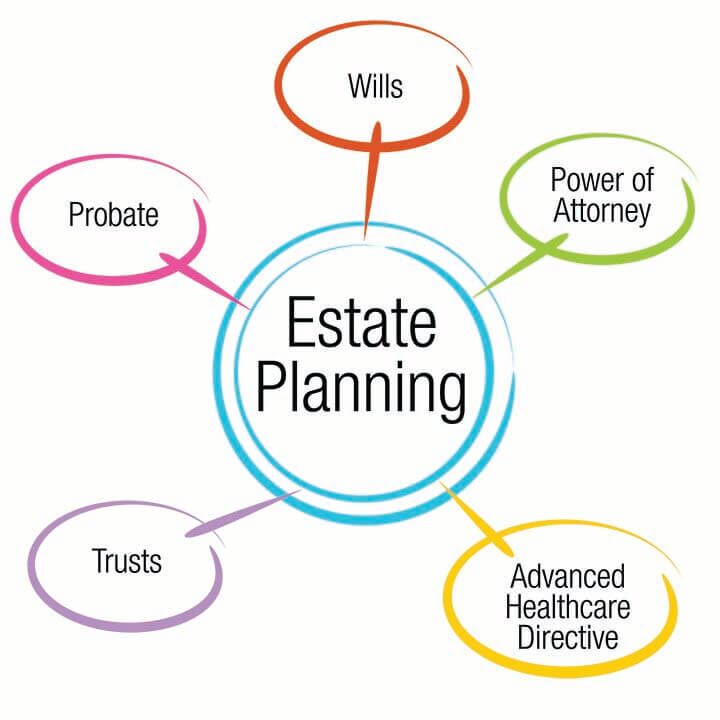

Estate Guidance involves managing your assets and affairs to ensure they're distributed according to your wishes upon your death or incapacitation. It typically includes creating a will, designating beneficiaries, and potentially establishing trusts to minimize taxes and avoid probate.

We work closely with you to understand your unique circumstances, offering customized solutions.

We provide holistic advice, including asset growth, management, and distribution.

We help you minimize taxes and navigate complex processes, ensuring financial security for you and your loved ones.

Dipak Bhatt

Certified Wealth Manager

Mihir Pandya

Data Analyst

© InvestMonk. All rights reserved.